Budget or Budgeting is about spending responsibly and planning ahead. It is how you allocate your money in order to live within your means. Your budget is a tool that can help you achieve your financial goals. Whether you want to save for a new car, pay off debt, or start investing, your budget will be there to help you accomplish these things.

This article will give you everything you need to know in order to create a realistic and achievable budget for the year ahead. Learn what’s needed to get started and how much money should be allocated for different expenses such as groceries, clothes, and entertainment. Read on for practical tips on tracking your spending and creating an action plan that works best for you!

What Is A Budget?

The word “budget” comes from the Old French word “boulogne,” which means “calf.” It most likely originated because a budget is like a cow that must be fed and cared for with limited resources. Today, the term refers to an estimate of how much money will be spent or received over a set period of time.

No matter your financial situation, creating a budget can help you gain control of your spending and put you on the path to financial success.

Creating a budget is easy! All you have to do is gather all your monthly expenses and divide them by 12 months so you know how much money should be allocated for different expenses such as groceries, clothes, and entertainment. You can also create an action plan that works best for you!

Why You Need A Budget?

When you’re living on a budget, it’s about spending responsibly and planning ahead. Your budget is a tool that can help you achieve your financial goals.

Whether you want to save for a new car, pay off debt, or start investing, your budget will be there to help you accomplish these things.

It’s helpful to create a realistic and achievable budget for the year ahead. Managing your money is about getting in the habit of tracking your expenses and making the right choices such as cutting back on unnecessary costs like dining out or commuting. It can be tough at first but with time and practice, you’ll find yourself living within your means more often than not!

Types Of Budget

There are a few different ways to budget, including cash-only, and envelope. Each way has its benefits and drawbacks depending on your needs.

Cash-only budgeting

is the simplest type of budgeting. It involves recording every expense in a monthly logbook or notebook. This system will help you track your spending habits and identify areas where you may be overspending. Drawbacks to this system include difficulty remembering previous purchases, difficulty categorizing expenses (i.e., whether they were necessities), and difficulty predicting future expenditures (i.e., unforeseen emergencies).

Envelope budgeting

involves assigning an individual bank account for each category of spending (i.e., grocery money, entertainment money, etc.). Once the money runs out in that account, it’s time to save up for next month’s allotment of funds. This system allows you to carefully monitor how much you’re spending in each area without any guesswork involved. Drawbacks include constant ATM trips to make sure you have enough money in your accounts; not being able to buy anything outside of the allotted categories; and large withdrawals from bank accounts if you need to purchase something outside of what’s already allocated.

How To Create a Budget With Ease

Creating a budget can be overwhelming for most people. But it doesn’t have to be. Simplify the process by using a budget template to help you stay organized and on track!

There are plenty of free templates available online with detailed instructions on how to use them. These templates allow you to create categories that work best for you and assign appropriate dollar amounts to each category. You can then track your progress and adjust your spending accordingly.

Budgeting is about living within your means, not depriving yourself of all the good things in life. Plan ahead, get organized, and find what works best for your personal needs and goals before getting started!

Reviewing Your Budget And Making Adjustments

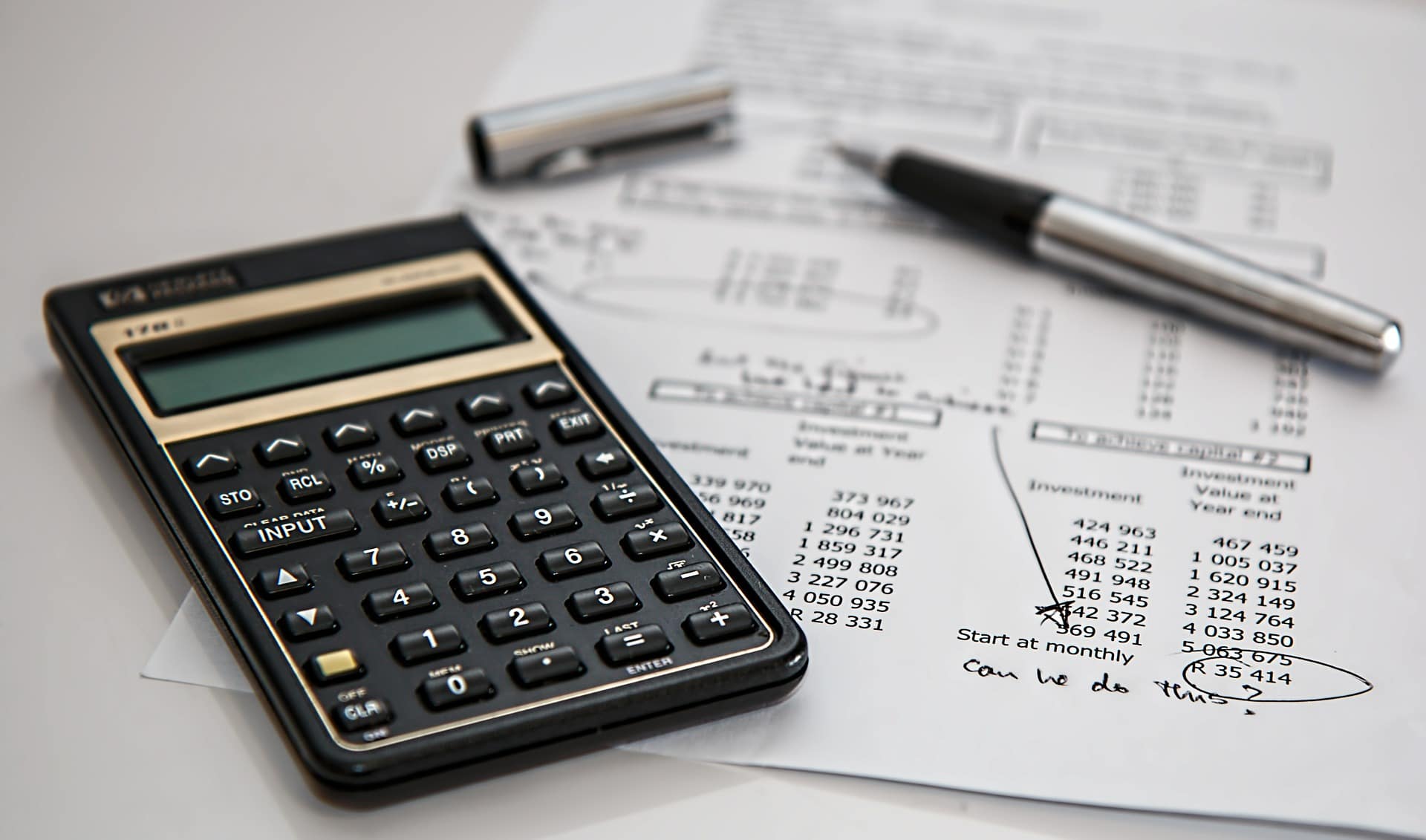

To create a realistic budget, you need to review how much money you currently have and what your future expenses will be. You can use a tool like Mint.com or Personal Capital to track your spending and determine how much of your income is going towards various expenses.

This is also the time where you can make any necessary adjustments. If you had an expensive month with unexpected expenses, you may need to adjust your budget for the next few months in order to stay on track.

Advantages Of Budget

Budgeting can provide many advantages. First, it helps you plan ahead and make sure you save for rainy days. Second, it helps you set aside money to use on things like vacations or investments. Third, budgeting can help you maintain a healthy lifestyle by keeping excessive spending in check. And finally, budgeting can give you peace of mind from knowing that everything is under control.

In addition to the benefits of budgeting, there are also some drawbacks you should be aware of. Budgeting takes time and effort to create and follow a plan that works best for your personal situation. It might also mean sacrificing some wants for needs at times or having to prioritize expenses based on importance or urgency. This sacrifice may cause feelings of anxiety or guilt if not done right – but fortunately with the right planning, those feelings disappear!

Conclusion

A budget is a tool that helps you make decisions about the things you do and the things you buy. It is a guide for your financial future. It can help you make good decisions about your money, make your money work for you, and protect your savings.

You don’t need to be an accountant to create a budget. All that’s required is some common sense, some paper and pencil, and fifteen minutes of your time each day or week. All it takes is fifteen minutes to help you make your money work for you.

[…] Read Also: What is Budget? Planning For Your Financial Future […]