There are hundreds of different cheap loan websites available near you, and it’s difficult to choose the best one for your needs. But if you’re looking for a cheap quick loan and don’t want to spend a fortune, we recommend looking at these tips for easy access.

5 Cheap Loans Tips

Consider these tips to identify cheap loan that has the lowest interest rates and the lowest fees. It will help you save hundreds of dollars over the course of the loan process, and they have the convenience of an online application.

Consider Your Credit Score

A low credits score rating can have an effect on your rate of interest. The federal funds rate determines the interest rate. Since 0% APR loans are not for everyone, these aren’t good options for many people. However, if you can get a low credit score and don’t have a stellar history, you’ll find lower interest rates elsewhere. There are also many online lenders with lower credit requirements.

Use An Online Personal Loan Site

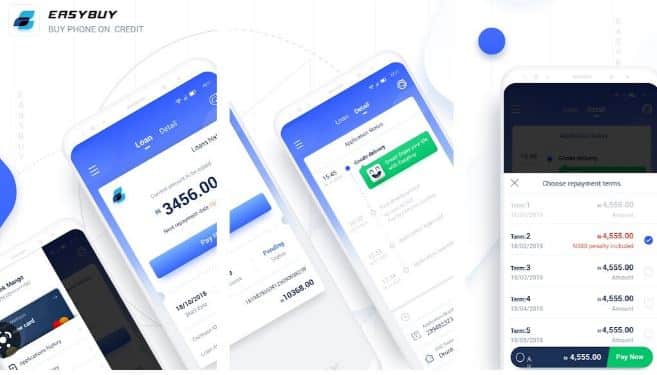

When you use an online personal loan site, you don’t have to worry about the credit score of the lender. Instead, the website will circulate your information to a network of lenders. The lenders will each present their own loan terms and conditions to you. Once you accept the terms, the funds will be deposited into your account. All you need to qualify is a bank account in your name and an income level of at least $16,000.

One of the best aspects of using a personal loan website is the ease of application. Most of the sites will circulate your information to multiple lenders. This way, multiple lenders will see your loan request and be able to bid on it. Once you accept the terms and agree to the terms, the funds will be deposited into your bank account. Bear it in mind that, it is a must to be 18 years of age or older, United State of America Citizen, and it is a must to have a bank account in your name.

Check Their Requirement

The best ways to get a personal loan with bad credit are online. Most of these sites will circulate your information among their network of lenders. They will present their loan terms to you, and you can then accept or decline them. Once you’ve accepted the terms, the funds will be deposited directly into your bank account. To be eligible for a loan, you must be at least 18 years old and a U.S. citizen.

Make Extensive Research with Internet

A good way to find a cheap loan is to use the internet. There are many websites offering these loans, but you should make sure you check their terms. For example, some websites offer higher interest rates than others, while some do not. Depending on what you need, you can find a cheap personal loan that’s right for you. A bad credit history can prevent you from getting a loan, which is why it’s important to look at online lenders with bad credit.

Check For Low Interest Rate

A good personal loan company should offer a low rate and excellent customer service. A good personal loan site should be able to match you with a lender regardless of your credit history. The best small business loan company is Lendio, which has an abundance of options and personalized matchmaking. Other sites include Fundera by Nerdwallet, which offers SBA microloans and Funding Circle. These sites are a great option for those with bad credit.

Those with bad credit may find that a small loan from a good company is better than a high interest rate loan from a bad one. Most of these companies have low interest rates because they focus on borrowers with poor credit histories. While these loans are not a good option for everyone, they are often very beneficial. By letting people borrow as much money as they need, these lenders have helped more than 100,000 people get loans in the United States.

Conclusion on Cheap Loan Tips

A personal loan site works with a network of lenders and helps people with bad credit get approved for loans. The lender will evaluate the applicant’s credit history and present them with a variety of loan options. After accepting the terms, the funds will be deposited into the user’s account. Applicants must be over eighteen years of age, a U.S. citizen, and have a bank account in their name.