You may wonder Why has Alibaba Stock Dropped in November

The company has reported that it is averaging a revenue growth rate of 40% for Q3 FY 2022.

The company’s gross merchandise value (GMV) rose 35% for the quarter, to a record $75.1 billion.

But the stock isn’t rallying despite this positive news.

That’s because the company’s management is not being rewarded for its strong results.

While the Chinese government is being cautious, there’s no evidence that the share price of Alibaba has fallen dramatically.

Why Is The Fall in Alibaba’s Stock Not Surprising?

The fall in Alibaba’s stock is not surprising. The company has been criticized for its failure to meet earnings expectations and has suffered from poor customer management revenue growth. This is a big tragedic spun for founder Jack Ma while the stock price falls and as the downfall of Xi Jinping. The company influence on china’s economy is just too much for them to ignore and the company itself is too big to fall

China Factor On Alibaba Stock In November

The Chinese government is stepping up scrutiny of Alibaba. While he has been allowed to speak to the press since October 2020, he hasn’t been allowed to comment on his businesses, including the e-commerce business. In fact, there’s no way to tell if the CEO is being harassed, or whether he’s just being a jerk. As a result, if you think that Jack Ma is in trouble, Alibaba isn’t worth a lot of money right now.

In the last few weeks, China has become increasingly aggressive in its regulatory environment. It’s not just a threat to the company’s IPO, but is actually a positive thing. The company’s CEO, Jack Ma, is under pressure from Beijing on a number of fronts, including labor policies and Xi Jinping’s “common prosperity” philosophy. As a result, Alibaba stock has dropped in value.

Common Prosperity Policy On Alibaba Stock

Alibaba Stock November dropped is also a concern for the company’s CEO. The company is under pressure from Beijing over labor policies, Xi Jinping’s “common prosperity” policy, and China’s aversion to the stock’s CEO’s role in the company’s future. As a result, its value has slashed in recent weeks. It’s possible that the Chinese government is merely trying to keep the stock from falling.

The underlying reasons for Alibaba’s drop are complicated. The company’s CEO has been under pressure from Beijing over a number of fronts, including labor policies and Xi Jinping’s “common prosperity” initiative. That’s the main reason why Alibaba’s stock has decreased. And the reasons for this are complex. If you’re looking for an explanation, read on. The Chinese government has been a significant force in China’s economy in recent years. They are influencing the world and bringing about a lot of social change.

Reason To Be Cautious With Alibaba Stock

While many investors think that Alibaba is the largest tech company in the world, this is not the case. The company’s business is booming, but the company’s finances aren’t doing so well. The Chinese government is demanding the CEO’s resignation. Its management isn’t paying enough to make that. But that doesn’t mean it’s a reason to panic. Also, this is a reason to be cautious.

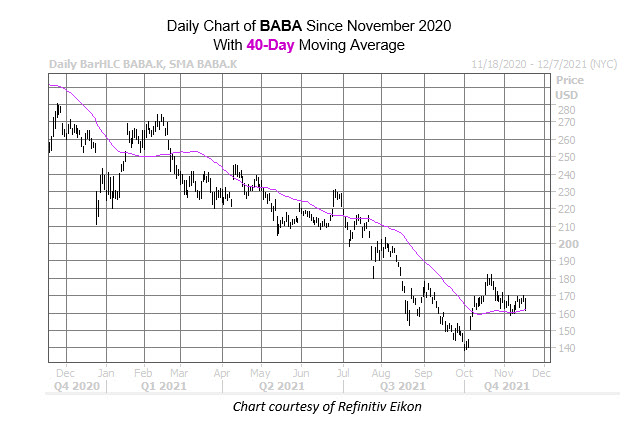

The company’s stock has dropped dramatically since October 2020. In fact, the drop followed a speech by Alibaba’s CEO, Jack Ma, which had attacked the Chinese government. Its stock was subsequently targeted by the authorities. The company has cited the uncertainty of the regulatory environment and the need to comply with privacy and data protection rules. But its share price has recovered by 30 percent from its October 2021 peak.

Conclusion On Why Alibaba Stock Dropped in November

Although Alibaba isn’t releasing its quarterly earnings yet, the company is boosting its stake in the stock in recent days. This is because the Chinese government has increased its stake in the company in July by 82.7%. As a result, the company is expected to report strong earnings in November, even though its revenue has dropped by 9% in the third quarter. The Chinese currency’s rising value has also helped the company’s growth.

[…] Also read: Why Has Alibaba Stock Dropped In November? […]